- The transition into retirement marks a significant phase of life planning. Consider financial preparedness, envisioning your post-retirement lifestyle, and exploring opportunities for continued engagement. Retirement planning is not just about financial security but also about creating a fulfilling and purposeful chapter.

- Prioritize health care and wellness in your life plan. Explore options for healthcare coverage, long-term care, and preventive measures to maintain optimal well-being. Regular health check-ups, a balanced lifestyle, and staying mentally and physically active contribute to a vibrant and healthy aging process.

- Ensure financial security through comprehensive estate planning. Review and update legal documents, such as wills and trusts, to reflect your current wishes. Addressing financial matters and potential healthcare costs provides peace of mind and a secure foundation for the years ahead.

- Cultivate social connections and engage with your community. Loneliness can be a challenge in later stages of life, and maintaining a strong social network contributes to emotional well-being. Explore local clubs, volunteer opportunities, or pursue hobbies that facilitate meaningful connections.

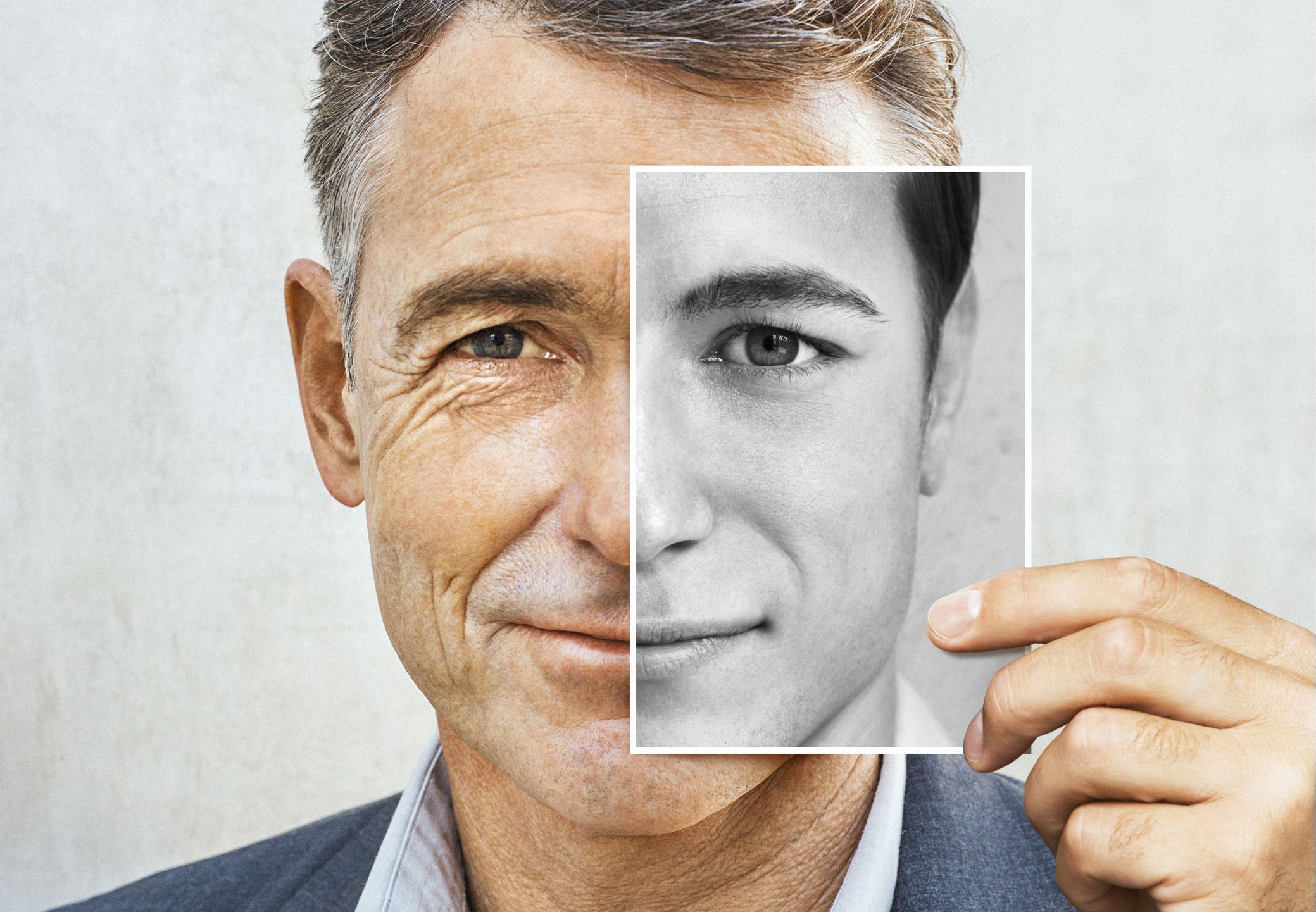

- Aging gracefully involves cultivating a sense of purpose and meaning. Explore activities that bring joy, satisfaction, and a sense of contribution. Whether it’s pursuing lifelong passions, engaging in mentorship, or participating in community projects, maintaining purpose enriches the aging journey.

- Embrace a mindset of lifelong learning. Pursue interests, acquire new skills, and engage in personal growth endeavors. Stimulating the mind through continuous learning contributes to mental agility and a sense of vitality.

- Envision your ideal retirement lifestyle. Consider where you want to live, the activities you wish to pursue, and how you envision spending your time. Creating a clear vision allows you to tailor your life plan to align with your retirement goals.

- Assess your financial situation in retirement. Ensure that your savings, investments, and pension plans align with your expected expenses. Seek financial advice to optimize your retirement income and make informed decisions about your financial future.

- Plan for healthcare and potential long-term care needs. Evaluate healthcare coverage options, explore long-term care insurance, and discuss preferences for medical care with loved ones. Proactive planning ensures a comprehensive approach to health and well-being.

- Aging gracefully involves embracing change with resilience. Recognize that transitions, both physical and emotional, are a natural part of the aging process. Cultivate resilience by adapting to new circumstances and maintaining a positive outlook.

- Foster emotional support networks. Surround yourself with loved ones, friends, and community connections. Open communication about feelings, fears, and aspirations strengthens emotional well-being and contributes to a sense of belonging.

- Integrate mindfulness and reflection into your routine. Take moments to appreciate the present, reflect on your life’s journey, and express gratitude. Mindful practices enhance emotional balance and bring a sense of peace.

- Consider your legacy and how you want to be remembered. Legacy planning involves reflecting on the impact you’ve made on others and the contributions you wish to leave behind. Explore opportunities for sharing wisdom, experiences, and cherished memories.

- Engage in reflective practices on your life’s journey. Document personal narratives, share stories with loved ones, and celebrate the milestones you’ve achieved. Reflection fosters a sense of accomplishment and provides a narrative thread connecting the chapters of your life.